“Silver is the investment of the decade. It has the best supply-demand fundamentals and is undervalued compared to gold. I believe it will outperform all other investments.”

– Eric Sprott, Billionaire Investor

Silver is a highly conductive and chemically unique metal, making it essential in modern industrial applications, particularly in green technologies. It plays a crucial role in solar panels, electric vehicles, and next-generation electronics due to its superior electrical and thermal conductivity.

Around 60% of global silver demand comes from industrial use, and this has grown significantly in recent years. According to Vikram Dhawan, Head of Commodities at Nippon India Mutual Fund, “Silver’s usage in greentech is propelling its industrial demand, especially from the solar and electric vehicle (EV) sectors. It also finds usage in high-end electronics and 5G technology.

This trend is expected to continue as global efforts to decarbonize and electrify industries accelerate. The transition to a low-emissions future will increasingly rely on silver, particularly across sectors such as:

Silver’s unique physical and chemical properties make it indispensable in the global shift toward decarbonisation and electrification. As the metal with the highest electrical and thermal conductivity of all elements, silver plays a critical role in energy transfer technologies. It is also the best reflector of visible light, a vital component in 5G networks, and possesses natural anti-bacterial properties. In addition, its malleability and ductility make it highly versatile across industrial applications. These characteristics, combined with rising demand in renewable energy, electric vehicles, and advanced electronics, continue to drive strong industrial demand for silver.

“Investing in silver now can capitalise on these unique advantages, positioning investors to benefit from both immediate industrial demand and long-term economic stability”

– Vikhram Dhawan from Mutual Fund

1,240 Million Oz annual consumption

820 Million Oz annual mine production

82% of annual silver supply sourced from mining

18% of annual silver supply sourced from recycling

7.8% since 2003 low vs. US average annual CPI 2.5%

7:1 silver: gold mine supply ratio

106:1 silver: gold price ratio in mid-April with a long term average of 60:1

Quote: Navneet Damani, group senior vice-president, head of commodities research, Motilal Oswal Financial Services.

“While demand has surged, supply has failed to keep pace. Mining production has been affected by labour shortages and environmental regulations, leading to tighter supplies.”

Paving the way for global electrification and helping shape a cleaner, more sustainable future, solar energy is emerging as one of the most critical renewable power sources. As an inexhaustible and pollution-free energy solution, solar continues to scale rapidly, particularly in global leaders like China and the United States.

In 2023 alone, China installed more solar panels than the U.S. has in its entire history, and its total solar capacity now exceeds that of the rest of the world combined. Meanwhile, the U.S. government has committed to achieving a 100% ‘clean’ electricity grid by 2035. To put the scale into perspective, approximately 3 million solar panels are needed to generate just 1 gigawatt of energy.

This global transition is driving significant demand for silver—an essential component in solar photovoltaic (PV) cells. As of the latest figures, silver demand for solar installations has reached 140 million ounces, accounting for 11% of total global silver consumption.

“Robust Greentech demand is driving the industrial use of silver, with around 60% of total demand coming from industry. Industrial demand has surged in recent years, especially in the solar and electric vehicle (EV) sectors, high-end electronics, and 5G technology,”.

“2024 has been a remarkable year for silver, with over a 30% price increase year to date, and experts predict further surges. Silver’s bull run is expected to continue due to compelling fundamentals. Silver’s fortunes in the medium to long term will be tied to the development of the greentech space,”

“The biggest positive for silver is climate change. Rising temperatures lead to a cycle of hotter summers and rising energy demand, resulting in higher greenhouse gas emissions. Solar energy is likely to be a massive part of the fight against climate change. Even by conservative estimates, the solar industry is forecast to grow over 30% in the next decade.”

“Silver is mainly mined as a by-product of zinc, lead, and a few other metals. Currently, the production cycle of these metals is not robust. The availability of scrap and concentrates is also low, which may prevent the market from returning to equilibrium before 12-15 months,” he concludes.

– Vikram Dhawan, Head of Commodities and Fund Manager at Nippon India Mutual Fund.

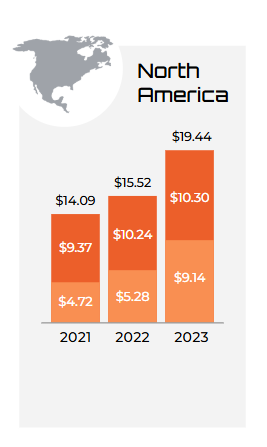

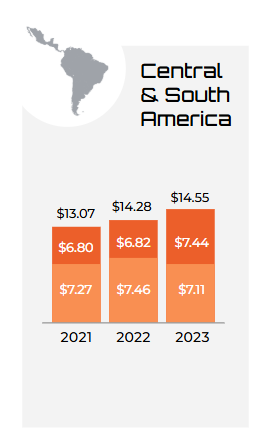

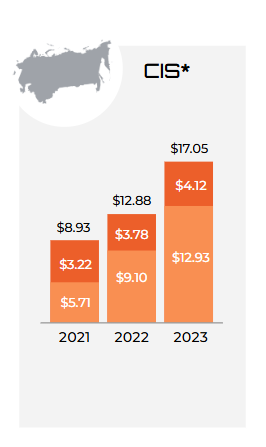

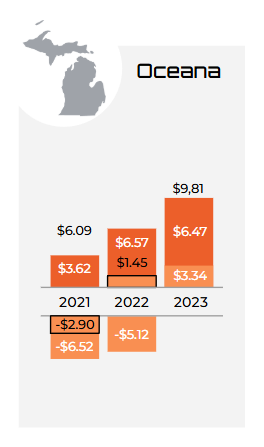

The All-in Sustaining Cost (AISC) of producing one ounce of silver is climbing across nearly every major mining region — a trend that strongly supports a bullish outlook for silver prices.

In North America, costs surged to $19.44/oz in 2023, reflecting mounting pressure from inflation, energy prices, and capital requirements. Similarly, CIS countries saw a sharp increase to $17.05/oz, highlighting growing geopolitical and operational challenges. Even traditionally lower-cost jurisdictions like Central & South America and Asia are not immune, with AISC rising to $14.55/oz and $8.91/oz, respectively.

This steady rise in production costs is tightening profit margins across the industry and raising the economic floor for silver prices. If prices fall below these levels, many producers would struggle to remain viable—putting upward pressure on the market as supply contracts. With demand simultaneously surging from solar, electric vehicles, and high-tech sectors, the fundamentals are aligning for a sustained rally in silver.

| YEAR | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Million ounces | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024F | 2023 | 2024F |

Supply | ||||||||||||

| Mine Production | 896.8 | 899.8 | 863.6 | 850.6 | 837.2 | 783.4 | 829.0 | 836.7 | 830.5 | 823.5 | -1% | -1% |

| Recycling | 147.0 | 145.7 | 147.2 | 148.7 | 148.2 | 164.3 | 173.7 | 176.9 | 178.6 | 178.9 | 178.9 | 1% |

| Net Hedging Supply | 2.2 | 0.0 | 0.0 | 0.0 | 13.9 | 8.5 | 0.0 | 0.0 | 0.0 | 0.0 | na | na |

| Net Official Sector Sales | 1.1 | 1.1 | 1.0 | 1.2 | 1.0 | 1.2 | 1.5 | 1.7 | 1.6 | 1.5 | -6% | -9% |

| Total Supply | 1,047.0 | 1,046.5 | 1,011.8 | 1,000.5 | 1,000.3 | 957.4 | 1,004.3 | 1,015.4 | 1,010.7 | 1,003.8 | -0.5% | -1% |

| Demand | ||||||||||||

| Industrial (total) | 457.1 | 489.5 | 526.4 | 524.2 | 523.5 | 509.7 | 561.3 | 588.3 | 654.4 | 710.9 | 11% | 9% |

| Electrical & Electronics | 272.3 | 308.9 | 339.7 | 331.0 | 327.3 | 322.0 | 351.2 | 371.3 | 445.1 | 485.6 | 20% | 9% |

| … of which photovoltaics | 59.6 | 81.6 | 99.3 | 87.0 | 74.9 | 82.8 | 88.9 | 118.1 | 193.5 | 232.0 | 64% | 20% |

| Brazing Alloys & Soldiers | 51.1 | 49.1 | 50.9 | 52.0 | 52.4 | 47.5 | 50.5 | 49.2 | 50.2 | 51.8 | 2% | 3% |

| Other Industrial | 133.7 | 131.5 | 135.8 | 141.2 | 143.8 | 140.2 | 159.6 | 167.8 | 159.0 | 173.5 | -5% | 9% |

| Photography | 38.2 | 34.7 | 32.4 | 31.4 | 30.7 | 26.9 | 27.7 | 27.5 | 27.0 | 26.1 | -2% | -3% |

| Jewelry | 202.5 | 189.1 | 196.2 | 203.2 | 201.6 | 150.9 | 182.0 | 234.5 | 203.1 | 211.3 | -13% | 4% |

| Silverware | 58.3 | 53.5 | 59.4 | 67.1 | 61.3 | 31.2 | 40.7 | 73.5 | 55.2 | 58.8 | -24% | 7% |

| Net Physical Investment | 309.3 | 212.9 | 155.8 | 165.9 | 187.4 | 208.1 | 284.3 | 337.1 | 243.1 | 212.0 | -28% | -13% |

| Net Hedging Demand | 0.0 | 12.0 | 1.1 | 7.4 | 0.0 | 0.0 | 3.5 | 17.9 | 12.2 | 0.0 | -32% | na |

| Total Demand | 1,065.4 | 991.8 | 971.3 | 999.2 | 1,004.4 | 926.8 | 1,099.6 | 1,278.9 | 1,195.0 | 1,219.1 | -7% | 2% |

| Market Balance | -18.4 | 54.7 | 40.5 | 1.3 | -4.1 | 30.6 | -95.4 | -263.5 | -184.3 | -215.3 | -30% | 17% |

| Net Investment in ETPs | -17.1 | 53.9 | 7.2 | -21.4 | 83.3 | 331.1 | 64.9 | -125.8 | -42.1 | 50.0 | -67% | na |

| Market Balance less ETPs | -1.3 | 0.8 | 33.3 | 22.7 | -87.4 | -300.5 | -160.3 | -137.7 | -142.2 | -265.3 | 3% | 87% |

| Silver Price (US$/oz, London price) | 15.68 | 17.14 | 17.05 | 15.71 | 16.21 | 20.55 | 25.14 | 21.73 | 23.35 | - | 7% | na |

| Source: Metals Focus | ||||||||||||

The supply and demand cycle for metals, including silver, works like any other market: when demand is higher than supply, prices tend to rise. In the case of silver, the market has been in a shortage for four years, with more silver being used in industries like electronics and renewable energy than is being produced by mines. As a result, the limited amount of available silver is becoming more valuable, which is pushing up prices. If mining companies can’t increase production to meet the growing demand, we could see silver prices rise even further.

“The silver market is experiencing its fourth consecutive year of structural deficit, driven primarily by increasing industrial demand. This deficit is expected to persist and so notably deplete above-ground stocks. A critical question now facing the market is whether mine supply can respond to restore balance.”

-The Silver Institute