A comprehensive evaluation of previous drilling results and JORC documentation indicates the potential to optimise and recalculate existing resources, potentially adding over 8,000,000 ounces of silver.

We have the opportunity to initiate the extraction of pregnant ponds and process and smelt an estimated 30,000-50,000 ounces of silver. This will bring the Texas Silver project back into production, making it one of the few operational silver mines in Australia, a notable differentiation for the IPO.

A 5,000-metre drilling program is planned for Q3 2024. Experts suggest this could significantly increase JORC silver resources by an additional 4,000,000 ounces.

By recalculating silver resources through the potential reprocessing of over one million tonnes of historical tailings and more than three million tonnes of chemical heap leach stockpiles using CIL processing, we could add up to 6,500,000 ounces of silver to the resources. These stockpiles are ready-to-access.

We aim to secure additional unexplored but targeted land on the borders of the existing tenements. Based on historical data, these areas are expected to contain significant high-yielding deposits. Successfully acquiring these tenements would increase the Texas Silver footprint by over 150%.

Historical core assays were only tested for base metals with the limited technology at the time and the costs where prohibitive. Reviewing and assaying historical core samples could confirm further silver resources that have not been brought to book due to the JORC requirements commercial quantities of critical metals identified in preliminary assays over the past twenty five years.

To act on these findings, a three-month drilling program is scheduled to commence in early September. The program will allocate 50% of its efforts toward upgrading existing resources by validating earlier drilling results, which the geological team believes will yield higher net resources. The remaining 50% will focus on exploring the three identified high-priority discovery sites.

The geological team has advised that during their Phase Two review, they have identified the potential to add a further five million ounces (silver equivalent) to the resources. We have tasked HSC to validate these findings. If confirmed, the resources, following the Phase One and Two audits, will rise from 19.5 million to 28.5 million ounces, significantly exceeding previous projections.

The geological team will then proceed with the final phase of their historical exploration work to assess additional potential increases to the resources, further enhancing the project’s value and opportunity.

Twin Hills is a sediment-hosted, low-grade silver-gold deposit with minor concentrations of zinc, lead, and copper. Approximately 25% of the known sulphide deposit was extracted during the previous open pit and heap leach operations at Twin Hills, leaving easily accessible outcropping silver-gold sulphide mineralisation in the pit floor, facilitating a straightforward restart of mining operations.

Mt Gunyan, located 3 km northeast of the Twin Hills pit, is an undeveloped silver-gold-zinc-lead deposit that outcrops as a prominent hill. The deposit is mostly oxidised, with silver mineralisation starting at the surface and continuing to depths of up to 150 metres, remaining open below this depth.

Silver Spur is a structurally controlled silver-base metal deposit situated 2km southeast of Twin Hills. Underground mining between 1892 and 1925 yielded approximately 2.19Moz of silver at an average grade of 800g/t, along with significant quantities of zinc, lead, copper, and by-product gold.

Modelling indicates that Twin Hills remains open at depth in several areas, where step-out drilling could quickly expand the mineralisation, particularly to the north where higher-grade mineralisation remains open at shallow depths and has not been tested below approximately 60 metres from the surface. Additionally, higher-grade silver mineralisation under the core of the deposit, where interpreted ‘feeder structures’ exist, presents an attractive target for further exploration.

At Silver Spur, mineralisation remains under-drilled. The block model suggests that high-grade silver-zinc Stokes mineralisation is open to the north, making it a priority target for expanding the resource. Furthermore, underground rock chip sampling from 1971, although not used in the resource calculations, indicates that higher-grade zinc and silver mineralisation extends beyond the current block model limits, representing another promising drill target. Near-surface oxide mineralisation outlined by previous drilling at Silver Spur North is also a prime area for further exploration.

Silver Star Resources will undertake geological re-evaluation and drill hole database validation at Webbs to prepare a maiden resource estimate for the high-grade silver base metal deposit. Additionally, a large geophysics program is underway in the Texas District to identify targets for a planned second-quarter drill program, which will prioritise high-grade Silver Spur-style targets. Preparations are also ongoing for the metallurgical and process study for the centralised processing facility.

A critical facility in mining operations, designed to house the equipment and systems used to extract, refine, and prepare raw minerals for market. Typically located close to the mining site, it provides a controlled environment for crushing, screening, and initial mineral separation processes. By centralizing these activities, a processing shed enhances operational efficiency, reduces environmental impact, and ensures worker safety, all while maintaining the quality and consistency of the final product.

Independent consultants HSC have completed an updated resource estimate for the Twin Hills deposit. This is 8.11 million tonnes at 50.2 Ag g/t, 0.06 Au g/t for 13.1 million ounces of silver. That is a 39% increase on the 2022 resource.The new estimate also classifies 4.5 Moz Ag in both measured and indicated categories where the 2022 had only 7.2 million in the indicated category.

The re-statement has not yet started. The 2022 MRE was 4.5 Mt at 38 g/t Ag, 0.04 g/t Au for 5.5 Moz Ag.

Preliminary work by HSC suggests that the 2022 model is not sustainable with very narrow lodes having been interpreted.A wider estimate, utilising lower grade assays has resulted in a first-pass figure of 1.8 Mt at 16 g/t Ag, 1% Zn, 0.4% Pb (~70 g/t AgEQ) for 1 million oz Ag, 4.1 Moz AgEQ. The ounce numbers are similar to the higher grade more tightly constrained 2022 model (0.7Mt at 54 Ag, 2% Zn, 0.7% Pb – 1.2Moz Ag, 3.4 Moz AgEQ).

Several prospects look to have potential for follow up (see map below).In very general terms there are prospects to the west (Hornet) and east (Argentum) as well as a 14km long NW-SE trend that runs semi-continuously from Silver Spur through Twin Hills to Tornado and Branch Creek. Limited drilling of these targets has been carried out and that historic drilling will be assessed going forward.

A drill proposal consisting of around 5,000m, costing roughly $1.5 million has been designed. HSC modelling suggests the potential for the program, depending on some success, to increase the confidence with 8.2 Moz Ag into measured and 4.4 Moz into indicated with an overall increase in Moz to 15.4.The drill program will need to be fine-tuned depending on access and early results.

H&S Consultants Pty Limited (HSC) was approached by Silver Star Resources to provide a review of Mineral Resource Estimates (MREs) for the Twin Hills deposit in southeast Queensland. Twin Hills is one of three deposits, together with Silver Spur and Mt Gunyan, that comprise the Texas Polymetallic Project.

Australian Mining Consultants (AMC) produced an MRE for the Twin Hills deposit in 2022 for Thomson Resources, that reported a significantly smaller resource than the 2016 MRE by DataGeo Geological Consultants for Moreton Resources Ltd. The 2022 MRE did not include any measured resources, while measured resources accounted for 29% of total metal in 2016.

A preliminary review by HSC identified some potential differences between the MREs based on limited information in reports provided by Texas, including:

HSC recommended the following steps to progress the review:

Texas then requested HSC to implement this proposal and also provided HSC with access to a large amount of information via SharePoint.

Based on the data provided, HSC has made the following observations:

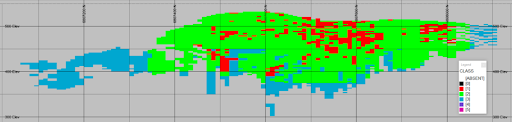

Figure 1: Section 6,807,683.5mN:

Left = AMC 2022 model,

Right = 2012 model

Respective mineralisation wireframes in red and 19/06/2013 topography in black.

Note: low default drill hole grades [dark blue] on AMC model, compared to missing grades [white] on 2012 model.

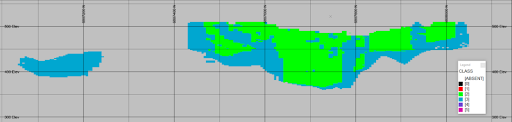

Figure 2: Resource classification in Long Section

Above = 2012 @ Ag > 26.5 g/t cut-off grade.

Below = 2022 @ eqAg > 25 g/t cut-off grade.

The figures to the left show some of the differences between the 2016 and 2022 MREs:

Figure 3: Histograms of Grade Distributions

Left: 24 drill hole grades – length weighted. Middle: 2012 block model grades, volume weighted. Right: 2022 block model grades, volume weighted

Histograms of the models show weirdly distorted grade distributions caused by the imposition of inappropriate 20g/t Ag grade thresholds to define mineralisation. Therefore, both models are almost certainly conditionally biased, and the AMC model appears worse.

Unfortunately, Global Ore Discovery did not produce a report, although there is some documentation in their spreadsheets.

Historically, a 20g/t Ag grade threshold has been used to define mineralisation at Twin Hills and this seems to originate from work by Cube Consulting in 2010. However, it appears that Cube basically accepted the existing grade threshold used by Alcyone and based their interpretation of strings provided by Alcyone: “A total of four wireframes based on 20m spaced sectional interpretations were created using a nominal low-grade cut-off of 20g/t Ag. In the absence of any geological logging or mapping Cube felt this was a reasonable statistical lower cut-off grade.”

| Year | Cut-off | Mt | Ag g/t | Au g/t | Moz Ag | % MozAg |

|---|---|---|---|---|---|---|

| 2016 MRE | 26.5g/t A | 8.37 | 51.0 | 0.080 | 13.7 | 100% |

| 2022 MRE | 25g/t EqAg | 6.10 | 48.0 | 0.060 | 9.4 | 69% |

| 2024 Check | 30g/t Ag | 8.11 | 50.2 | 0.060 | 13.1 | 95% |

In terms of classification, if the quality of drill hole data is assumed to be reasonable, then around half of the estimate might be classified as measured.

However, one major issue is the general lack of QAQC data for the pre Alycone holes, which constitute the majority of the drilling: “There is no record of standards or blanks being included with samples submitted to the Laboratories prior to Alcyone’s involvement. Field duplicates were taken from the RC and PC holes.” Alcyone holes comprise ~ 10% of the total database.

The majority of the other holes are open percussion holes (OPH), a method not generally considered suitable for resource estimation. The Alcyone analysis of diamond core and RC versus open hole Ag assays suggests a positive bias in the open hole results. There is no recovery data for most holes apart for the small proportion of diamond core holes.

The majority of OPH were drilled by Macmin between 1995 and 2002 and comprise ~54% of total meterage drilled; these are between 30 and 60 metres in depth. There are also three deeper holes (150m) drilled by CRAE in 1982 that appear to be OPH; Hughes 1982 reported about the CRAE drilling that: “At this stage, verification of grades obtained by percussion drilling is necessary. A short diamond drill hole immediately adjacent to PD81TH2 should achieve this test, followed by lateral testing of the mineralised zone to ascertain grade and tonnage of the resource by the type of drilling deemed to be most appropriate”.

In order to address these issues, HSC generated some additional check estimates including:

The models including and excluding the open percussion holes (OPH) were assessed over a 300m interval (6,807,600-6,807,900mN) where the coverage OPH and other hole types are broadly comparable. This comparison shows very similar results, as presented in Table 2, although the model without OPH does show marginally lower average grade. However, this comparison does not show a significant bias due to the OPH.

| Check Model | Mt | Ag g/t | Au g/t | Moz Ag |

|---|---|---|---|---|

| Includes OPH | 26.5g/t A | 51.7 | 0.071 | 8.39 |

| Excludes OPH | 5.169 | 50.3 | 0.075 | 8.35 |

| % Difference | 2.4% | -2.8% | 5.3% | -0.5% |

HSC then took the initial classification (CLASS24) for the model including the OPH and downgraded it by one class for blocks influenced by >50% (CLASS24A) and >25% (CLASS24B) OHP holes. From the initial 58% of metal as Class 1 (potentially measured), these changes reduced measured to 42% and 34% of metal, which is not too severe. The majority of OPH are shallow and drilled from surface, so are largely mined out apart from a few deeper holes. The most conservative new estimate (>25% OPH) is still more optimistic than the 2016 MRE Class 1.

| Class | Mt | Ag g/t | Au g/t | Moz Ag | %totMoz |

|---|---|---|---|---|---|

| CLASS24 | 4.546 | 52.3 | 0.070 | 7.64 | 58% |

| CLASS24A | 3.122 | 54.4 | 0.084 | 5.46 | 42% |

| CLASS24B | 2.550 | 55.0 | 0.091 | 4.51 | 34% |

| 2016 MRE | 1.640 | 75.8 | 0.100 | 4.00 | 29% |

The 2024 check model was generated at the request of Texas as a “second opinion” to try and resolve the differences between the 2016 and 2022 MREs. Results of this work suggest that the 2016 MRE is more likely to be correct.

The 2024 model is merely an independent check estimate and was never intended to replace the earlier MREs reported publicly under the JORC code. The check model is a quick and simple “order of magnitude” estimate, and a more comprehensive exercise would be required to generate an estimate that could be reported publicly to JORC 2012 guidelines.

10.3Moz AgEq at a grade of 52g/t AgEq

5.9Moz AgEq at a grade of 41g/t AgEq

3.2Moz AgEq at a grade of 156g/t AgEq

Eoin was educated at Trinity College, Dublin, Ireland, and spent ten years in the resources industry, exploring copper, zinc, uranium, gold, and silver before emigrating to Australia in 1989. Near-mine exploration followed at the significant base metal deposits of Broken Hill and Macarthur River. Moving to WA in 1997, Eoin supervised the drill out and resource estimation of the first million-ounce underground gold resource at Jundee Gold Mine. Eoin was Joseph Gutnick’s lead geologist for many years, and then at Consolidated Minerals from 2001, Eoin was in charge of the successful manganese exploration at Woodie, which discovered 15 million tons of ore, increasing both the mine life and resource base 4-fold, as well as managing successful iron ore, chromite and nickel exploration. Eoin was Managing Director of ASX-listed India Resources Limited (IRL) for three years starting in October 2006. IRL’s Surda copper mine broke a 50-year production record in its first full year.

*Silver Equivalent Ag Eq (g/t) = [Ag (g/t) + 64.5 x Au (g/t)+ 26.1 x Pb(%) + 125.1 x Cu(%) + 37.8 x Zn(%)] calculated from prices of US $28.12/oz Ag, US $1814/oz Au, US $10117.5/t Cu, US $2228.5/t Pb, US $3061.5/t Zn and metallurgical recoveries of 85% Ag , 85% Au, 90% Pb, 95% Cu , 95% Zn estimated from test work.

A 5,000 meter drilling program commenced in December 2024.

A 3-month drilling program is scheduled to commence in the latter part of 2024. Approximately half of the program will focus on upgrading existing resources by validating earlier drilling, which the geological team believes could result in an increase to the overall resource estimate. The remaining time will be dedicated to testing three high-priority discovery targets identified through recent geological analysis.

The program will be executed to the highest technical standards, with a focus on safety and operational efficiency. It will be overseen by a management team with over 100 years of combined experience across all major drilling techniques.

Recent drilling at TX7 has delivered encouraging preliminary results, including an intercept of 7.5m at 39 g/t silver (Ag) from a depth of 45.7m, based on averaged pXRF readings taken every 10cm. This intercept is located 25m southwest of the crushing plant (32m from the surface) and 15m north of the northernmost.

A shallow line of older RC drill holes, predating the construction of the plant, includes hole THP265, which intersected 18m at 19 g/t Ag directly beneath the plant at a depth of 11m.

Within TX7, a notable 1,099 g/t Ag vein was identified, with hints of a red-coloured mineral suspected to be Pyrargyrite. Pyrargyrite, a silver-rich sulphosalt, has been previously documented in petrology reports from the Texas area. While the mineral’s occurrence in this vein is subtle, it reinforces the potential for high-grade silver mineralisation.

These pXRF readings, while informative, are preliminary and subject to variability. Selected intervals, including the 7.5m intercept and high-grade vein, have been marked for laboratory assays to provide more definitive results. It is anticipated that lab assays will validate and potentially upgrade the grades indicated by the pXRF.Further updates, including assay results and an updated resource estimate, will be provided as new data becomes available. The proximity of these intercepts to existing infrastructure and resource blocks further enhances the project’s development potential.

Historical core assays were primarily tested for base metals using the limited technology available at the time, and the costs were prohibitive. Reassessing and assaying these historical core samples could confirm additional silver resources that have not yet been reported due to JORC requirements. Previous assays have identified commercial quantities of other minerals. There has also been significant discussion regarding the presence of other critical metals in samples taken by various entities, beyond the primary minerals of silver (Ag), copper (Cu), gold (Au), nickel (Ni), and zinc (Zn).

Recent XR gun sample images have revealed significant indications of high-grade iridium (Ir) and platinum (Pt). Professional assays conducted by a competent provider will enable us to determine whether these metals exist in mineable quantities and whether they present a value-added opportunity. Assaying the existing samples will provide a more comprehensive understanding of the minerals available for processing. All new drilling and exploration work will be tested for the full range of minerals.

By recalculating silver resources through the potential reprocessing of over one million tonnes of historical tailings and more than three million tonnes of chemical heap leach stockpiles using CIL processing, we could add up to 6,500,000 ounces of silver to the resources. These stockpiles are ready-to-access.